Overview

Background

Visa’s global clients — from major banks to fast-growing Fintechs — rely on settlement instructions to move funds worldwide. For years, this process depended on outdated forms and manual workflows, leading to delays and errors.

To modernize, Visa launched the Settlement Funds Transfer (SFT) initiative, introducing two platforms:

SFT Manager (SFTM): An enterprise tool for Treasury staff to manage client settlement instructions with accuracy and control.

SFT Online (SFTO): A self-service portal enabling clients to initiate and track settlement instructions digitally.

Together, these platforms streamlined settlement instruction management end-to-end — cutting onboarding from weeks to days and earning Visa’s CFO Award for Customer Obsession.

Problem

Visa’s legacy Settlement Account Manager (SAM) had been in use for over 20 years. They no longer met the needs of a global financial network.

Key pain points:

Endless manual data entry → frequent mistakes

Setup and modification could take up to 30 days

No real-time validation or guidance

Confusing layouts and navigation

Poor accessibility and outdated UI

Settlement Account Manager (SAM) — outdated, error-prone systems created inefficiency for clients and Visa teams.

Understanding Users

I began the project by interviewing Treasury staff and observing their workflows. These sessions revealed inefficiencies, duplication of work, and confusion across roles. Clients submitted Word forms by email, which Visa employees manually re-entered into SAM — leading to delays, errors, and lack of visibility into progress.

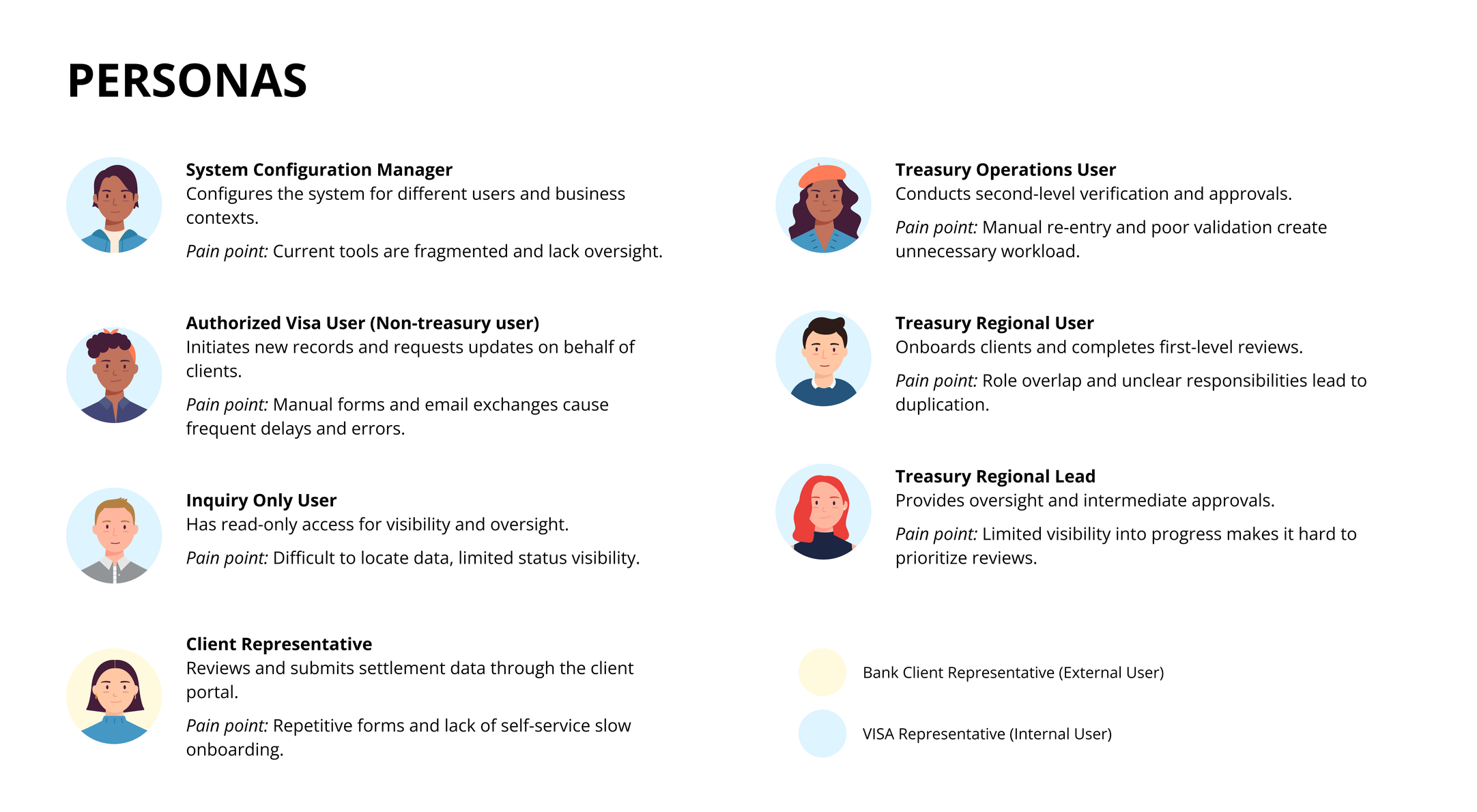

To capture these insights, I created personas that outlined responsibilities and pain points across both clients and Treasury staff.

Personas summarized responsibilities and pain points across Treasury and client users

Pain points by user group:

Bank clients (makers, checkers): Confused by unclear roles, no visibility into status, and repetitive form-filling.

Visa Treasury staff: Spent hours re-entering data, struggled with outdated layouts, and had no real-time validation to prevent mistakes.

To reduce role confusion, I also mapped permissions. This clarified who could initiate, review, or approve records, reducing overlap and ambiguity.

Permissions clarified who could initiate, review, or approve records.

Improved workflows

Based on the research findings, I mapped and redesigned two core flows:

Record Setup: Clients enter details → Visa verifies → record goes live

Record Modification: Clients request changes → Visa validates → updates applied seamlessly

The redesigned workflows replaced emailed Word forms and manual entry with guided digital processes. Clients could self-serve through SFT Online, while Treasury staff managed reviews and approvals in SFT Manager — cutting onboarding time from weeks to days.

Design Process

The design process emphasized rapid prototyping, testing, and refinement across global user groups. This iterative process ensured that every solution was tested, validated, and aligned with real user needs.

Phase 1

SFT Manager MVP

Key enhancements:

Redesigned long forms into clear, multi-step flows with progress indicators

Grouped related fields logically, removed redundancies

Introduced progressive profiling to reduce user burden

💡 Impact: Treasury analysts found navigation easier and reported significant time savings.

Phase 2

Further improvements and refinements

Key enhancements:

Conducted accessibility audit → achieved VGAR Level 5 compliance

Added real-time validation and precise error messaging

Integrated Visa’s product design system for consistency

💡 Impact: Usability testing score of 4.2, with employees describing the experience as “great” and “time-saving.”

Phase 3

SFT Online for Clients

We expanded the solution to external clients with SFT Online — a self-service platform for managing settlement instructions.

Key enhancements:

Self-guided portal → no more paperwork or endless emails

Smarter error handling → clear correction tips, highlighted issues

Transparent progress → track and modify records in real time

Results:

Reduced service turnaround from 2 weeks → 1 day

Saved 160+ hours/month for client services

Saved 200+ hours/month for treasury teams

User feedback

I collaborated with a researcher to test near-final workflows with both Visa Treasury staff and external bank clients. Their feedback validated the improvements and also highlighted opportunities for future enhancements.

Bank clients valued efficiency, self-service capabilities, and clearer error handling.

Visa Treasury staff appreciated features that saved time, clarified status, and supported better reviews.

Future Vision

I designed the platform with scalability in mind. The next steps focused on extending impact through automation and smarter collaboration:

Automated error checking by cross-referencing Visa systems

Smarter notifications and activity tracking for better transparency

Expanded client self-service features to reduce dependency on Treasury staff

Impact

Major improvements delivered:

Efficiency: Onboarding cut from weeks to days; 200+ hours saved per month for Treasury teams.

Transparency: Progress tracking and activity logs provided clear visibility.

Error Reduction: Real-time validation lowered failed submissions.

Accessibility: Achieved VGAR (Visa Global Accessibility Requirements) Level 5 compliance, the highest standard at Visa.

🏆 Recognition:

Honored with Visa’s CFO Award for Customer Obsession for measurable improvements to client experience.

Reflection

As the sole designer, I led the full journey — from uncovering user pain points to delivering globally scalable solutions. The process was grounded in research, refined through iteration, and validated with rigorous accessibility and compliance reviews.

End-to-end design journey — from research to implementation.

Key takeaways

Start with users: Direct interviews and workflow observations revealed the real pain points.

Iterate with evidence: Every design decision was validated through usability testing with Treasury staff and clients.

Balance rigor with speed: Combined accessibility audits, QA, and iterative improvements without slowing delivery.

Design for impact and scalability: Delivered measurable efficiency gains, improved transparency, and a roadmap shaped by user feedback — earning recognition at Visa’s executive level.